Technology for Better Binders Business

Noldor provides a digital platform for finding, brokering, and managing reinsurance capacity.

A data-agnostic approach to aggregation

Noldor directly integrates with MGAs regardless of tech stack to unlock unprecedented opportunities for MGAs, reinsurance brokers, and carriers/reinsurers alike.

For

MGAs

Noldor connects with best-in-class carriers, Lloyd’s syndicates, and Bermuda reinsurers around the world.

Our continuous underwriting engine uses AI/ML to provide daily oversight on your book of business, uncovering hidden drivers of loss ratio.

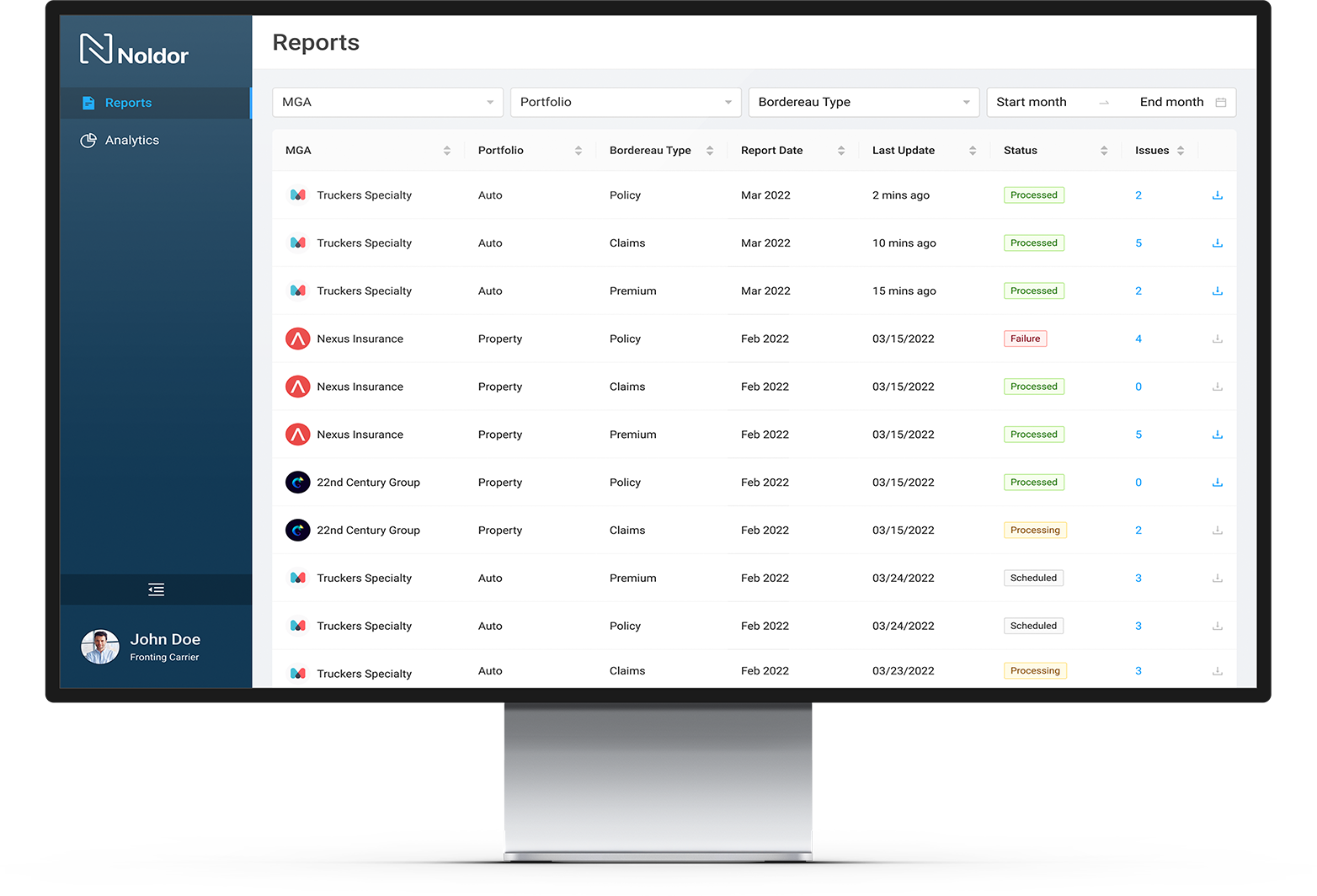

Reduce back office expenses by automating bordereau reporting, contract management, and other applied data applications.

Bank-level encryption and API integrations help to improve cyber risk and ensure regulatory compliance with multiple international jurisdictions.

For

Carriers +

Reinsurers

Gain peace of mind when giving away the pen. With daily level transparency enabling you to put the program underwriter just outside your door.

Turnkey access to program data via API, enabling capital providers to grow their business without blowing out their expenses.

Determine where your MGAs are finding their sweet spot and provide more dynamic coverage to give them the runway they need to profitably grow.

Fully configurable alerts enable for seamless contract management.

For

Reinsurance

Brokers

Noldor helps reduce fraud for carriers by improving data quality – helping differentiate programs amidst a hardening market.

Noldor Brokers may receive brokerage opportunities from our MGA partners.

Leveraging Noldor can provide brokers with new digital channels to expand their reinsurance brokerage business.